529 Conversion To Roth Ira 2025

529 Conversion To Roth Ira 2025. One of the key provisions of secure act 2.0 is a provision allowing conversion of a 529 plan to a roth ira. As of 2025, it’s possible to roll unused 529 plan funds into a roth ira without penalty.

The secure 2.0 act, which became law in december 2025, makes it potentially more attractive to make a 529 to roth ira conversion starting in 2025. Starting in 2025, you can also transfer money from 529 plans into roth iras.

As of january 1, 2025, when you discover you have extra money in your child’s 529 plan, there is a fourth option to select from.

529 Limits 2025 Elset Horatia, 0.35% for balances over $50,000. Beneficiaries of a 529 plan will be able to convert a lifetime total of $35,000 from a 529 plan to a roth ira without incurring taxes or penalties.

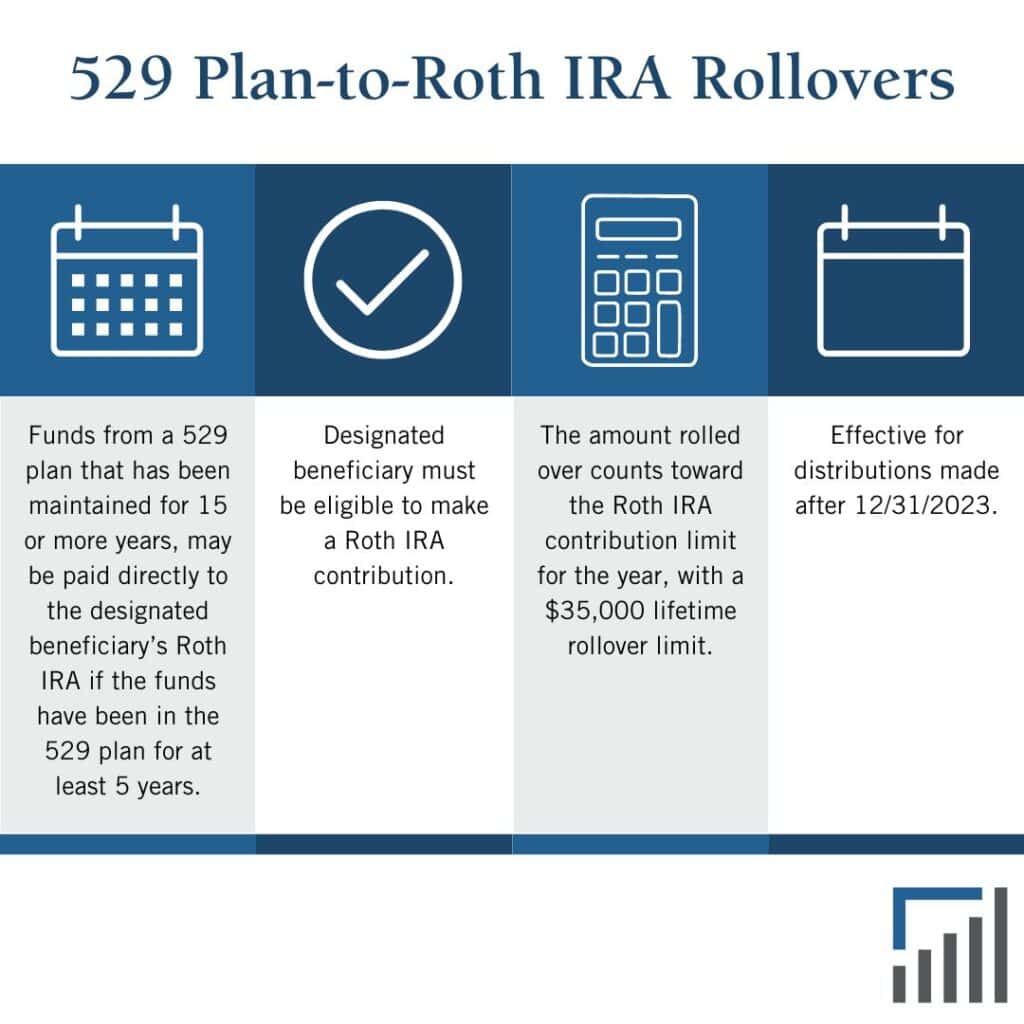

Understanding 529 PlantoRoth IRA Rollovers in 2025, The new rules for 2025, however, that will enable account holders to transfer up to $35,000 of unused 529 savings to a roth ira retirement account for their child may put some. The 529 plan must be open for at least 15 years.

529 to Roth Conversions, Converting to a roth ira — the counterpunch to the rmd. Starting in 2025, there is one more escape valve to a 529—the 529 to roth ira rollover.

New 529 Plan to Roth IRA Rollover A Powerful New SECURE Act 2.0, As of 2025, the following rules apply to. You’ll soon be able to roll over funds from your 529 plan into a roth ira, thanks to recent legislation.

529 vs. Roth IRA The Annuity Expert, Starting in 2025, you can roll unused 529 assets—up to a lifetime limit of $35,000—into the account beneficiary's roth ira, without incurring the usual 10%. As of 2025, it’s possible to roll unused 529 plan funds into a roth ira without penalty.

What To Do With Leftover Money In A 529 Plan?, One of the key provisions of secure act 2.0 is a provision allowing conversion of a 529 plan to a roth ira. There are some important rules:

Utilizing the 529 to Roth IRA Transfer Rule Fontana Financial Planning, 10 reasons to save for retirement in a roth ira. As of 2025, it’s possible to roll unused 529 plan funds into a roth ira without penalty.

Irs 529 Contribution Limits 2025 Rory Walliw, The 529 plan must be open for at least 15 years. Fidelity ira has a $0 fee for balances under $10,000;

401k Roth Ira Contribution Limits 2025 Clio Melody, The roth ira rule can help 529 beneficiaries avoid taxes and penalties for nonqualified withdrawals. This provision takes effect in 2025, not 2025.

529 Plan vs. Roth IRA The Best College Savings Plan EveryBuckCounts, The 529 beneficiary must also. The secure 2.0 act, which became law in december 2025, makes it potentially more attractive to make a 529 to roth ira conversion starting in 2025.